We will now take a look at the different sides of the debate. Classical liberals, following David Ricardo’s theory of comparative advantages, approve the ratio, expecting more efficient exchanges between the European Union and the USA. On the contrary, those who are defending the rights and the protections of workers, producers and consumers wish for a radical reconsideration of the terms of agreement, or for a permanent block of the on-going negotiations, in fear of a serious loss of rights. Keeping in mind that TTIP involves regions that account for over the 50% of global exchanges, and then considering the possible economic and political consequences on the European integration process, we believe a European Federalist point of view is now essential.

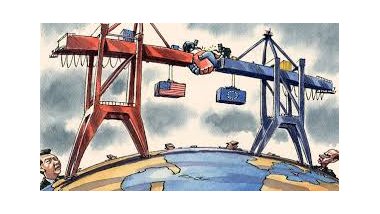

Let us start from the source, asking ourselves: “What is TTIP?” The TTIP, or better Transatlantic Trade and Investment Partnership, is a treaty halfway between a free trade agreement (aimed at the reduction/ abolition of tariffs and duties) and an economic union (aimed at designing common production standards, as expressed by the European Commission).

Which of these aspects is the major one? With no doubt, the second: the weighted-average tariffs are by now very low for both sides, among 2 -3%; an additional reduction cannot lead to huge results. Instead, a higher incentive towards an increase in exchanges could be represented by the abolition of the non-tariff barriers, or better of the different production standards which boost the costs of overseas trade. Which macroeconomic changes could all these measures bring? Because the agreement is still being discussed, we have no certain answer. However we have estimations. We can rely on five studies: Ecorys (2009), CEPR(2013), CEPII(2013), Bertelsmann(2013), Capaldo(2014).

The first four are based on the World Bank’s model, from the neoclassical tradition; the last one is based on the UN model, with a Keynesian approach. The results are contradictory, in different ways. Let us see the main trends. The most important is a rise of trade flows between the European Union and the USA (towards Washington the estimation is from 28 to 60%; towards the Old Continent from 37 to 80%) and the concurrent reduction of intra-EU trade (estimations go from a 2 to 42% of reduction). A second important common trend is that interventions on non-tariffs barriers mainly cause these changes. Let us focus on the first one and go back to our purpose: trying to look at TTIP with a federalist point of view. Is it useful for the European integration process to increase economic interdependency with USA and to decrease the internal one? In addition, having called the topic of European integration to attention, another question arises: is an agreement between a Federal State, with a budget of more than 25% of its GDP, and a Monetary Union, without an actual Federal government and with a budget of less than 1% of its GDP, an equal agreement? Can it generate equal conditions?

The answer is obviously no. The European Union, in order not to be the weak partner, has to create a Federal government in the Eurozone, with a fiscal policy assuring equal distribution; meanwhile it has to define its internal levels of integration. Moving on to the second trend, which non-tariff barriers should be abolished? Mainly two: the rights of workers (we must not forget that the European Union has acceded to the Conventions of International Labour Organisation, while the USA has not done so yet), and the quality and provenance guarantees (a crucial difference between the two areas is the licence of trading: the EU applies a precautionary principle; the USA requires scientific evidence of the danger of a good to ban it). In these circumstances, the European Parliament gave a first signal in defence of rights on the 8th of July when, in addition to Tspiras’s audition, they approved a resolution on TTIP containing the demand for the application of the precautionary principle over trade, judicial protection on trademarks with a European geographical indication, and the indication of the judiciary authorities for dispute settlement. But this position cannot be defended if we do not have enough power (a government responding to the European Parliament and a federal budget).

Even if the European Union provides itself with a federal government and budget, a central element will still be missing: a reform of the international monetary order. The 1994’s post-NAFTA agreement tells us the reason (free trade agreement among Canada, USA and Mexico): after signing it, President Clinton declared that it would have brought millions of jobs. In reality, they numbered only 1.7 million or perhaps even less. The cause? The halving of the Mexican peso in 1994 which tipped the balance of payments between the two countries in favour of Mexico City. Certain and predictable effects of TTIP cannot forgo evaluation of the unstable international monetary system; with the only consequence of moving to a global unit currency. Otherwise, we cannot imagine the effects on TTIP of the fluctuations of the two currencies worth 50% of all goods exchanges and 80% in financial ones of the whole world.

In conclusion, the European Union has first to fix its institutional deficits. Secondly, it could use the TTIP as an instrument to reform the international monetary system and to spread rights overseas rather than merely fiscal and physical goods.

I have to thank Domenico Moro, coordinator of the Debate Office of the European Federalist Movement, author of the paper “Il “trattato transatlantico” (TTIP): nucleo o ostacolo di un nuovo ordine mondiale economico-monetario?”(“The transatlantic treaty (TTIP): core or obstacle of a new global economic and monetary order?), presented at the conference Le grandi aree commerciali e i loro rapporti: il negoziato transatlantico” (“The great trading areas and their relationships: the transatlantic negotiation") organised by the Einaudi Fundation of Turin on the 20th of May; this article has taken large parts from that.

Follow the comments: |

|